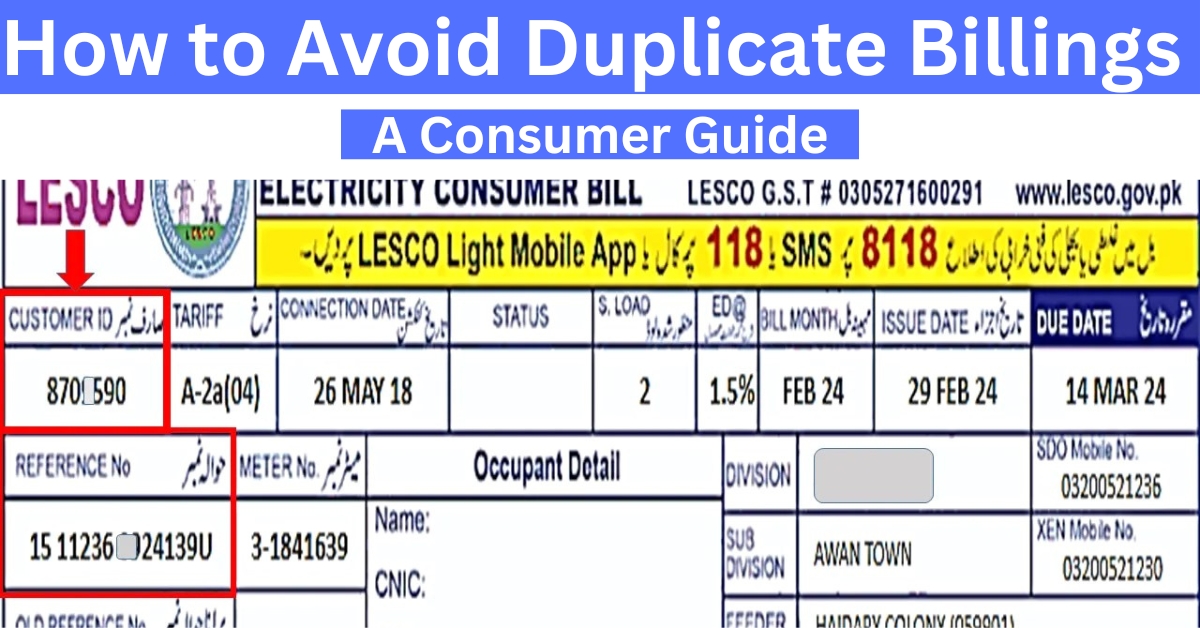

A duplicate billing is frustrating and costly for a consumer. A duplicate bill may be a charge on the same product as another, or he may be billed twice for the same item, or he is charged for something he does not know for what he is being charged. The more complex and automated the billing, the more likely it can cause errors. Eventually, businesses will get it right, but consumers have to take an active role in preventing the worst-case scenario of overpayment.

This paper will discuss actionable tips to the consumer on how not to fall victim to duplicate billing and achieve financial security.

Table of Contents

What Is Duplicate Billing?

Double billing occurs when the consumer is being charged twice for the same service, good, or transaction by the same consumer. The mistake may also arise from looking at two nearly identical bills or a charge to their credit card several times, or receiving a request to pay for something for which that account had already paid. Double billing can result from any scope-from healthcare to utilities and subscription services and retail industries-to mention but a few. It should be corrected at the initial stage to avert the excess payment and the right bill bookkeeping.

How to Avoid Duplicate Billings

- Periodical Review of Invoices and Statements The best way to prevent duplicate charges is periodical review of your invoices and of your checking statements. If receiving a paper invoice or electronic bill, you have to pay attention to every charge. Some people overlook small charges. Over time, duplicates can accumulate, especially if they are being attached as legitimate.

Review Bills

Verify line items: All the products or services that are listed should be what you ordered. Ensure that the same thing is listed under more than one name.

Check dates of services or subscription: Ensure that the date for the service or when you start subscription is correct. At times, this can lead to a situation where two charges fall under different billing periods.

Compare to records: Keep a record of your transactions-some of the bigger ones. Compare this with what is indicated in your statement.

You will be able then to pick many mistakes early when billing and inform the billing department so you are charged a bit less than due - Check Out Your Bank and Credit Card Statements

This is much easier to automatically enroll oneself but much quicker to miss fraudulent charges. Any person must check their bank and credit card statements each month to find duplicate transactions. Indeed, mostly businesses charge a credit card twice by mistake, especially dealing with recurring payments.

How to Keep Track Duplicate billing:

- How to Avoid Duplicate Billings Consumer Guide.1

- Duplicate Billing Causes and Solutions.2

- Sui Southern Gas Company Limited Career Opportunities August 2024

- Sui Northern Gas Pipelines Limited Jobs 2024

- Sui Southern Gas Company Limited Jobs 2024

Activate alerts. Many banks and credit card companies offer e-mail or even text alerts for over a certain dollar amount or when a transaction of a payment is being processed. These often allow you to catch the fraud before it really gets too far along.

Use Apps to Track Personal Finance. Apps like Mint, YNAB, and many others track and aggregate your transactions. You are most likely now to catch dups across accounts.

Check Statements. Habituate yourself to regularly reviewing your bank and credit card statements monthly on the regular. Even though you might set up automatic billing with an entity, you want to ensure they are not double-dipping on you.

- Avoid Subscriptions

In most subscription services provided for entertainment or software or month-to-month delivery, there are usually many fees-coupled typically with doppelganger charges. Consumers forget that it is often them who enrolled in the service thus paying an additional fee for service that is unnecessary. Some consumers unintentionally and unknowingly enroll for a service twice using slightly different email addresses or accounts. It can lead to double-charging.

Track subscription: Write down the list of subscriptions on a note with corresponding date for billing, amount and pay frequency. Using this record, you will easily determine the duplicate ones.

Check on different accounts. During the account-making process, one finds himself/her registering different forms that are numerous. This forces most consumers into ending up with multiple accounts to provide the same services. Check if you are among them since you paid once for the same service with different email addresses or usernames.

Remove Duplicates: Call to inquire if you have more than one subscription when you are charged double and triple on the same service and remove the duplicate. - Retain Copies of Paid Bills and Receipts

Thirdly, ensure that you keep clear records of your payments and look out for any duplicate bills. Be keen on services that are recurring such as utility bills, medical bills, or subscription services.

Best Practices in Record Keeping

Save all your Receipts: Whether it is in paper form or electronic form, all of your receipts were saved until you are confirmed that the right payment was received.

Payment Tracker: You can easily create an excel sheet tracing down every single payment made by you. It may include date of transaction, amount and confirmation number. This may be helpful as well in case you are arguing with a duplicate bill.

Ask for Confirmations: the confirmation that you receive upon making payment for the bill ensures that indeed you paid for it. It can be through email or any other form of receipt. Failure to obtain confirmation indicates possible lapse within the processing process that may even lead to extra charges incurred. - Take initiative and call for customer service

In case you find a charge that you already paid for the same thing, then wait not to call them. Call immediately for you have to contact the customer service of the business right away. The earlier you see the mistake, the quicker it will be to rectify and this reduces the likelihood of a second charge going through.

How to Process Disputes

Be Prepared: If you’re going to use the customer service line, you would want to have all your documentation in order. They need an account number for you, what it was for, and all of your receipts or confirmation numbers that came in when the transaction went through.

Request the Company to Have It Cancelled or Refunded in Writing: Ask the business to provide you with written confirmation that this duplicate charge is canceled or refunded.

Watch Next Billing Cycle: Wait until your case is resolved and check your next billing cycle to see if indeed the mistake has been corrected.

- Consumer Protected Payment Options

The modes of payment are also different from one another in terms of protection for consumers. For example, the risk of duplicate billing is relatively minor for credit cards, whereas that of debit cards and direct bank transfers is more significant. Credit card issuers offer a facility known as chargeback related to any transaction, which can be debited on apparent error or duplication.

Recurring Payment Credit Cards. Recurring payment credit cards are safer from fraudulent transactions and chargebacks that make it easier to rectify the problem of duplicated charges.

Direct Bank Transfers Be Used for Only Large Purchases: A direct bank transfer is harder to dispute if duplicated; however its use should only be limited to large purchases where available.

Use Virtual Credit Cards: Some credit card companies now have virtual credit cards that can only be used once. You could use those, then avoid the business from charging extra if more charges will be made. - Be On the Watch with Automated Payments

Convenient, but sometimes you are charged twice because of system failures or human lapses of the billing department. Just monitor them if you will be putting up automatic payments.

Managing Tips on Automatic Payments:

Mark reminders to occur on your dates of automatic payments so you can check your accounts shortly after that for duplicates.

Follow through and continue paying suppliers through automatic payments to whom you are comfortable and have gotten their invoices correct frequently.

Pay Yourself First-Automatic Payments: Click on pay terms before each pay so you can have a screenshot taken beforehand that would let you identify how and when the transactions are going to be processed. That will make it much easier for you to identify errors.

- Know Your Consumer Rights

As a consumer, you have the legal right to dispute a billing complaint if it is to be billed for a service that you did not receive or was billed on multiple instances for the same item. Of course, there are many other consumer rights laws throughout each state and from various utility companies, so you may have the ability to file a complaint on an overcharge or exact copy of the same bill.

Know Your Rights:

Check the federal and local legislation. Federal consumer protection law protects you from unfair billing practices as defined by the Fair Credit Billing Act (FCBA) in all countries or states, which also may have local specific regulations.

Discover the company’s billing policy. Research the process of a dispute, how long they take to settle an issue by viewing the companies you deal with and especially their billing policies.

Conclusion

If one is alert and proactive, double-charging can be avoided. The major options for prevention here would include checking bills regularly, monitoring every statement, keeping detailed records, correcting mistakes as soon as possible. From the payment options, several offer sturdier consumer protection against paying for the same service twice. Knowing what your rights are about these billing systems makes dealing with them much more comforting.

Great tips for staying on top of duplicate billings. It’s practical advice, but I’m curious—how often do you recommend doing the review of invoices and statements? Monthly might work, but even missed charges can pile up. A guide on how to keep everything organized would be a lifesaver. Thanks for breaking it down!